Your accessplanit platform offers a wide variety of different VAT inclusive, exclusive, and exempt options which can be set at different levels within the platform. Below is a breakdown of all of the available VAT options, and where they are located.

Users Level

Users Tax Exempt

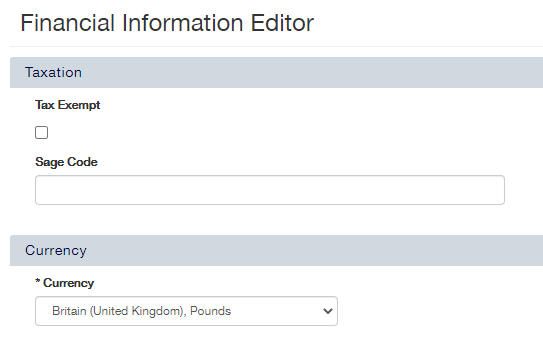

This field can be found within the User's Financial tab.

When this box is ticked, the user won't pay VAT on courses they book onto privately. However, if they book on via the Account they're in, the Account must also be VAT Exempt for the booking not to include VAT. This has no effect on courses that are Tax Exempt, as all booking users are automatically Tax Exempt on these courses. If a course is not Tax Exempt, however, the user won't pay VAT on their booking.

Account Level

Account VAT Exempt

This field is found within the Account's Details tab, under Taxation Details

If this box is ticked, bookings under this Account are VAT exempt but only if the User is also marked as Tax Exempt. This has no effect on courses that are Tax Exempt, as all booking users are automatically Tax Exempt on these courses. If a course is not Tax Exempt, however, the user won't pay VAT on their booking.

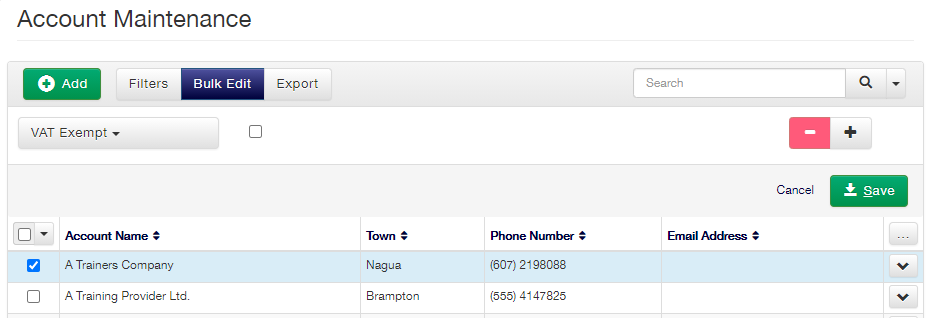

You can also change by using the Bulk Edit functionality within the Account DataGrid.

Course Level

Course Template Tax Exempt

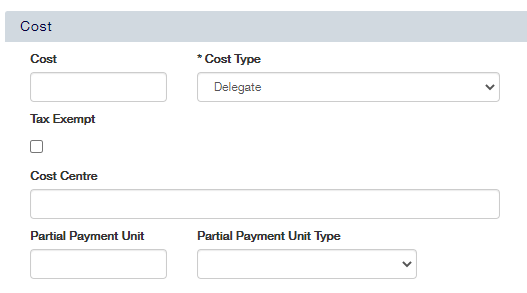

This field can be found in the Course Template Details page, under Cost.

Ticking the Tax Exempt box here will make any instances of this Course Template Tax Exempt. Ticking this box leaves the course cost for this these courses unaffected (so if a course is £25, it will cost the delegate £25 regardless - unless they're Tax Exempt), but the amount of the course that is VAT will change. So if a course is VAT exempt, it'll cost £25 with no VAT. If the course has VAT, it'll be £20 plus £5 of which is VAT.

Course Tax Exempt

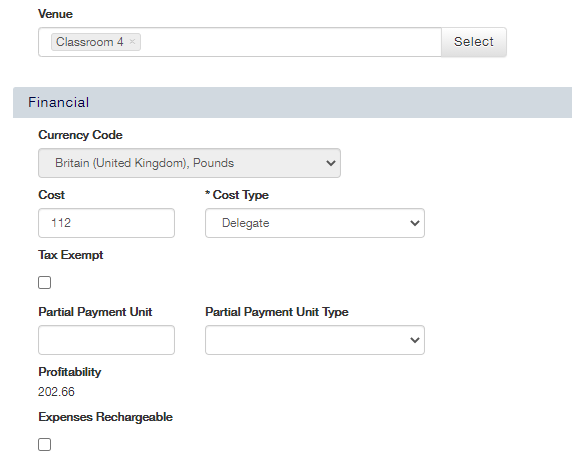

The Course Tax Exempt field can be found in the Course's Class Details tab, under Financial.

As with the Course Template Tax Exempt field, ticking this box leaves the course cost unaffected (so if a course is £25, it will cost the delegate £25 regardless - unless they're Tax Exempt), but the amount of the course that is VAT will change. So if a course is VAT exempt, it'll cost £25 with no VAT. If the course has VAT, it'll be £20 plus £5 of which is VAT. However, this tick box only effects this particular instance of this course, rather than all courses under this template.

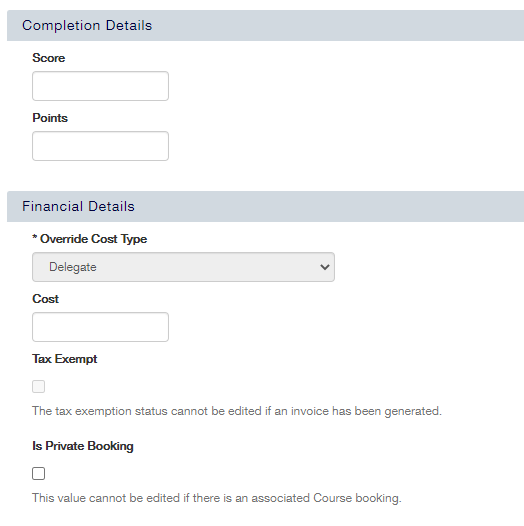

Delegate Tax Exempt

This field can be found with the Delegate Maintenance Details tab, under Financial Details.

Set at the delegate level, this tick box overrides any VAT settings at the User or Account level and will mean that the Delegate won't pay VAT on courses. This has no effect on courses that are Tax Exempt, as all booking users are automatically Tax Exempt on these courses. If a course is not Tax Exempt, however, the user won't pay VAT on their booking.

Account Finance Level

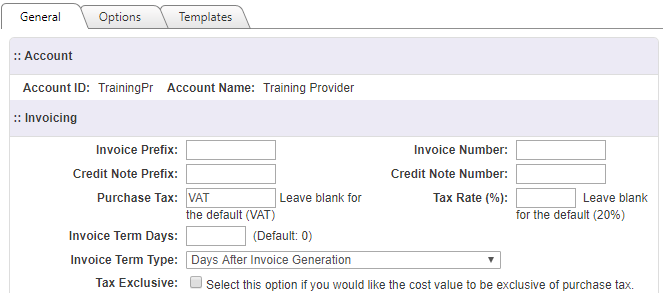

VAT exclusive in the Account Finance Options

The Tax Exclusive field can be found within Administration - Account Finance Options.

This field determines whether the course cost of courses delivered by the selected Training Provider includes VAT or doesn't.

If this box is left unticked, a course with the cost of £25 course will be £25 including VAT, so its cost will remain throughout the Shopping Basket.

However, if the Training Provider is set to be VAT Exclusive, the £25 course cost is just the NET amount. This means that any delegates booking onto the course will have VAT to pay on top of the course cost.

For example, if the Tax Rate is set to the default of 20%, the delegates will have to pay 20% of the course cost to pay on top of the £25 they are already being charged for the cost - meaning that the course will actually cost them £27.17.

Only Tax Exempt courses will have the same amount on the platform and at the end of the Shopping Basket.